Some software stocks have gotten even cheaper

Despite an average rise of eight percent since the start of the year, many software company stocks are cheaper now than six months ago and one year ago, based on a group of one hundred and sixty-one software stocks out of a total universe of about five hundred and fifty U.S.-listed tech stocks.

Although estimates have been cut amidst a rough market for software, the fact that some names are even cheaper now than their already discounted prices before, makes them worth considering.

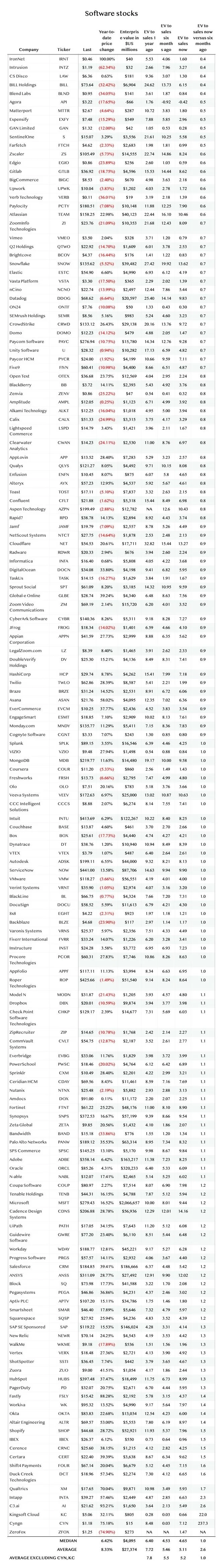

The table below plots the change in one key measure for software stocks, their enterprise value divided by the next twelve months’ projected revenue according to FactSet consensus. Enterprise value is the total value of the company when you add up the shares outstanding and then subtract net cash, meaning, cash and equivalents and long-term investments, less long-term debt.

The reason for EV-to-sales is that, aside from in infatuation with growth by software investors, many are not profitable, so it’s a more uniform way to compare all stocks.

The table is sorted by the last column, the ratio of today’s EV-to-sales multiple to what it was six months ago, in ascending order. The stocks whose current EV-to-sales is the smallest relative to six months ago are at the top of the table.

If you look at the bottom rows, you can see the median and average measures. You’ll notice that both the median and the average ratio of the current EV-to-sales is one, meaning, the same as it was six months ago.

However, some stocks have gotten more expensive, with a ratio above one, while others have surprisingly gotten cheaper even after sharp price gains this year.

In those cases, the increase in share price isn’t as great as the rate of revenue growth. For example, CrowdStrike is up twenty-six percent this year so far. But the revenue consensus for the next twelve months, $2.998 billion, represents growth of thirty-four percent above the prior twelve-month period. So, CrowdStrike’s multiple of EV to sales is about a third less expensive than it was six months ago.

CrowdStrike is one of the TL20 stocks worth considering.

Note that there are a couple of names on here that are in the process of being taken private, part of the parade of merges and acquisition of the past twelve months. They include Qualtrics and VMware. Those two stocks are worth taking note of because they represent what a comfortable take-out multiple can be for software.

And there’s quite a disparity. Qualtrics’s take-out price represents almost six times projected revenue, while VMware is being bought for only four times.

The reason for the disparity, in my view, is that Qualtrics is being bought by a consortium of investors that includes the Canada Pension Plan Investment Board and Silver Lake Management, and it’s being bought from a large corporate majority owner, European software giant SAP SE; whereas VMware is being bought from the public by a strategic buyer, Broadcom, which is going to directly include the property into its operations.

I think when you get financial investors, and large corporate owners, prices can tend to end up being higher, while a thrifty corporate buyer, especially a fellow such as Broadcom CEO Hock Tan, may tend to be more frugal.

The upshot of this is, with the IPO window still closed, and, hence, the supply of software investments constrained; and, healthy growth for some software stocks, now is still the time you may find good deals despite the rise in price of some stocks.

Feel free to download the entire spreadsheet in Excel format.