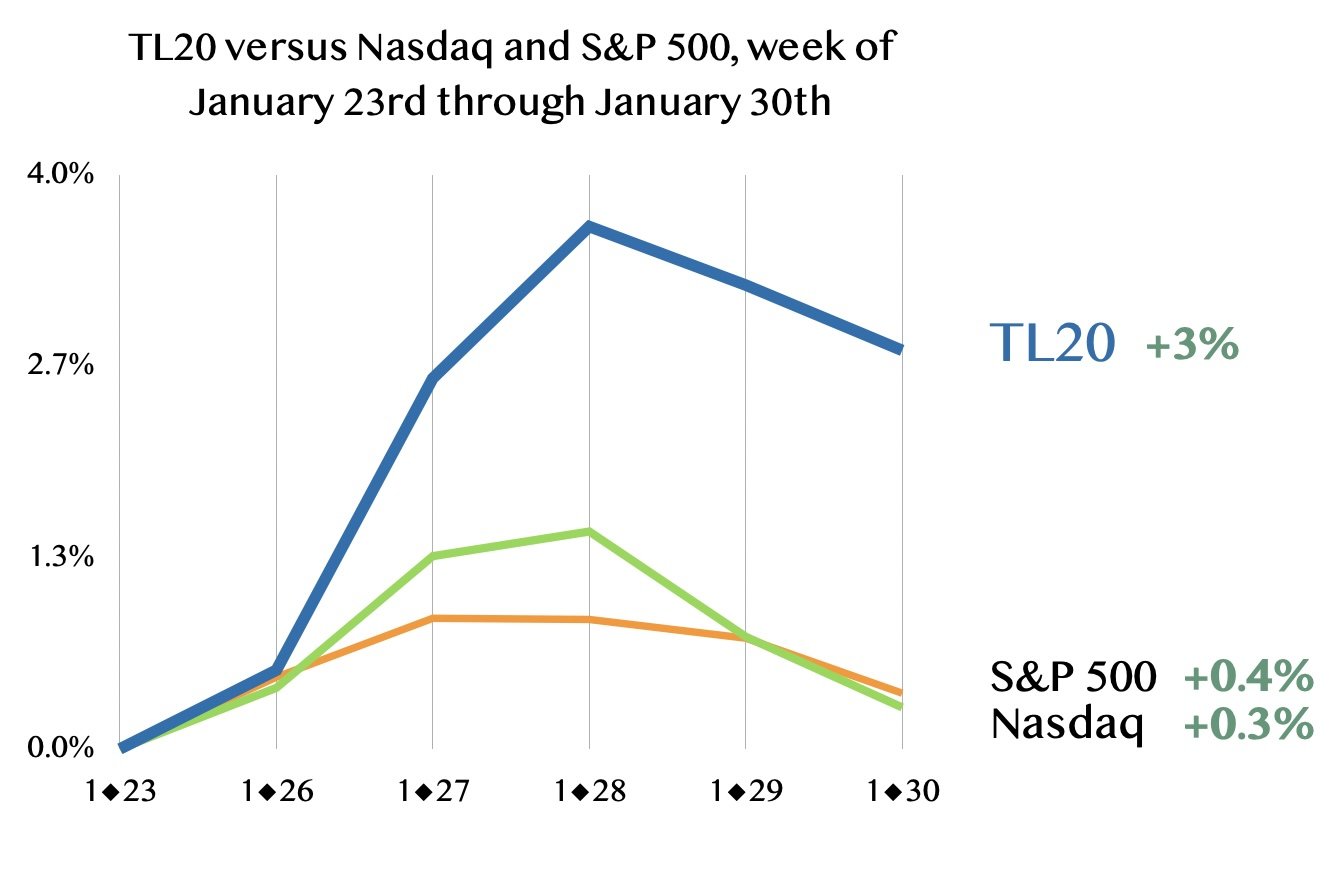

TL20 leads benchmarks

Year-to-date, the TL20 group of stocks to consider is up eight percent, better than the one-percent gain of the Nasdaq and the S&P 500. Read about the TL20

Tiernan Ray discusses the mission of The Technology Letter.

I have to admit I have spent this week being choosey about earnings coverage, paying less attention to the reports of Meta Platforms and Microsoft and Apple. That’s because what is happening among infrastructure makers is just so much more interesting.

Take the case of SanDisk, which is up twenty-four percent in early trading on Friday, at $663.50, an expansion of the seventeen-point move Thursday night, after the company blew away expectations by the widest margin since it separated from Western Digital last April.

Revenue of $2.5 billion was thirteen percent above the average estimate. Profit per share was also sharply higher, $5.20 versus the consensus $3.03.

And the forecast for this quarter’s revenue is fifty-seven percent higher than the consensus, $3.9 billion versus an expected $2.4 billion.

This is the kind of surprise that happens not that often. It’s like May of 2023, when Nvidia’s forecast for revenue offered the most upside anyone could remember.

Among Thursday’s earning winners, Lam Research’s report showed business continues to soar on all the artificial intelligence chip demand, and related parts. The stock closed up over three percent at $248.17, and helped to lift shares of peers such as KLA and Applied Materials.

This is the second major chip-equipment positive this week, following ASML’s report Tuesday morning.

Price targets were zooming, the highest I saw being $325 from Mehdi Hosseini of Susquehanna Financial.

The key positive is Lam raising its outlook for the entire “WFE,” or, wafer fab equipment market, the general catch-all term for the equipment industry. Lam now says the market will rise to $135 billion, around twenty-three percent growth from what Lam says was probably $110 billion for the industry last year.

Competitor KLA, reporting this evening, and also offering an upbeat report and outlook, is saying something similar, “in the mid-$130 billion range” for 2026, according to its shareholder letter. KLA noted that “The industry outlook for calendar 2026 has strengthened over the past few months.

Among Thursday’s earning winners, Lam Research’s report showed business continues to soar on all the artificial intelligence chip demand, and related parts. The stock closed up over three percent at $248.17, and helped to lift shares of peers such as KLA and Applied Materials.

This is the second major chip-equipment positive this week, following ASML’s report Tuesday morning.

Price targets were zooming, the highest I saw being $325 from Mehdi Hosseini of Susquehanna Financial.

The key positive is Lam raising its outlook for the entire “WFE,” or, wafer fab equipment market, the general catch-all term for the equipment industry. Lam now says the market will rise to $135 billion, around twenty-three percent growth from what Lam says was probably $110 billion for the industry last year.

Competitor KLA, reporting this evening, and also offering an upbeat report and outlook, is saying something similar, “in the mid-$130 billion range” for 2026, according to its shareholder letter. KLA noted that “The industry outlook for calendar 2026 has strengthened over the past few months.

The stand-out this morning is fiber-optics maker Viavi Solutions, soaring by thirteen percent to $23.82, after Wednesday evening’s results and outlook topped expectations — the fourth quarter in a row the shares have rocketed on the report.

What’s adding an extra bounce to things today is the company’s plan to cut five percent of its workforce, about 180 people. The company expects to save $30 million annually by doing so. CFO Ilan Daskal said in prepared remarks the move was to “better align workforce and resources with our current business needs and strategic priorities.”

IonQ’s CEO, Niccolo de Masi, was kind enough to chat Wednesday morning about the company’s announcement Monday it is buying semiconductor contract manufacturer SkyWater Technology for $1.8 billion.

De Masi’s main pointed, repeated several times, is that SkyWater is a unique asset as being both a “secure” facility for manufacturing, as it is located in the U.S., as well as having the expertise specifically in fabricating a variety of parts for quantum for a dozen or more customers, including superconducting parts for companies other than IBM, which has its own factories, and quantum annealing chips for D-Wave Quantum.

“This gives us effective leadership as the U.S. quantum foundry of choice,” said de Masi. He noted the “tailwinds” of the administration of U.S. President Donald Trump that is emphasizing domestic manufacturing.

“We can build under tight lock and key, and we can make sure we are the leading partner for the DoW [Department of War,” said de Masi. “We can know we are building something that was not copied and ripped off.”

Earnings reports Tuesday evening and Wednesday morning are seeing the payoff of very broadly positive trends we’ve been watching, including the artificial intelligence build-out.

Wednesday morning’s jump in shares of ASML in pre-market trading, and the big after-hours gains for Texas Instruments and Seagate continuing into Wednesday morning, each come with the expected positive developments but with a little extra wrinkle to make things even more upbeat.

We had good news for Corning and Amphenol as well Wednesday morning. However, with their shares up twenty-five percent and twenty-three percent this year, I suspect the good news was not good enough for the highest expectations. As a result, they’re selling off on the news.

The week that ended January 23rd saw stocks fall fractionally for the major indices, Nasdaq and Standard & Poor’s 500, and a one-percent fall for the TL20 group of stocks to consider, and the names that sold off the hardest suggest the divide between artificial intelligence infrastructure and everything.

Names hardest hit last week include Snowflake, Nutanix, Samsara, and Palo Alto Networks.

The “gold rush” companies, those selling the “picks and shovels,” analogous to any prospecting period such as The Great Gold Rushin 19th Century America. That includes Nvidia, Micron Technology and Arista Networks.

The companies that are not explicitly gold rush companies, such as Snowflake, are not enjoying the same gains, which is true for most of the software group, for a long time now.

The sense that we are in unprecedented times — that artificial intelligence changes everything, that we are on the cusp of discovering the quantum mysteries of the universe — has prompted many easy-money moves among high-flying equities.

Such a move came again on Monday morning from IonQ, one of the triumvirate of quantum computing companies along with D-Wave and Rigetti. The company announced it is spending $1.8 billion in cash and stock to acquire publicly traded SkyWater Technology of Bloomington, Minnesota, for $35 a share. SkyWater, which came public in the spring of 2021, is a boutique contract chip makerthat is best known for fabricating the quantum chip used by D-Wave Quantum.

The deal was not far above SkyWater’s close on Friday of $31.32, as SkyWater stock has been on a tear, up 72% since the start of the year — much better than the five-percent gain for IonQ in that time.

In its press release, IonQ said buying SkyWater will speed up IonQ’s roadmap for the number of “qubits,” the quantum equivalent of a traditional transistor. Specifically, IonQ has been telling the Street it will have 200,000 “physical” qubits in 2029, as was featured in a slide deck at a Bank of America conference in November:

Shares of Intel sank by about five percent in late trading after the company beat with its fourth-quarter revenue but offered a forecast for this quarter roughly three percent below what the Street has been modeling.

Intel shares have been incredibly strong heading toward this report, up a hundred and forty-nine percent in twelve months, and forty-seven percent just since the start of the year. Hence, it is not surprising to see a sharp sell-off on the lackluster forecast.

Intel tends to sell off on its January earnings reports, so, this is perhaps typical. Also, the company has missed with its revenue forecast in three out of the prior four quarterly reports, so, that’s also par for the course.

We’re in the first week of tech earnings, with Netflix reporting as I record this. The week just ended, the week of the 16th of January, was one with good news for the artificial intelligence trade. We’ll come to all that in a moment.

On Monday, I posted a dissection of all the AI expectations. I went back to that infamous JP Morgan report from November, the one that projected $5 trillion in spending on data centers over the next several years.

I dug into the background material, which includes historical data and projections from The International Energy Agency, a multi-governmental policy research group based in Paris, which is overseen by the Organization for Economic Cooperation and Development.

Intel is on tap to report earnings Thursday evening, after the closing bell. The stock has been stellar up till now, rising a hundred and forty-nine percent in the past twelve months at Wednesday’s close of $54.25.

The stock tends to sell off hard on earnings: the last five Januarys, the shares have sold off an average of eight percent following the fourth-quarter earnings report. And last year, the shares sold off following three of four quarterly reports, by an average of six percent.

But, there’s reason for hope: Several people are seeing rising prospects.

Tuesday, Seaport Research analyst Jay Goldberg raised his rating to a Buy from Neutral, with a price target of $65, writing that the company stands to regain share in consumer and enterprise PCs this year as its newer CPU, “Panther Lake” goes on sale. Panther Lake is for notebook computers, and it’s significant as it returns manufacturing to Intel’s own factories, specifically, the Chandler, Arizona, factory known as “Fab 52,” whereas previously Intel laptop chips had been made by Taiwan Semiconductor.

I consider Netflix, which I’ve written about for over twenty years, to be less and less within my sphere of expertise, as it is less and less a tech company and more and more a media company.

Case in point, the only thing that matters for investors, the morning after a mixed fourth-quarter report, is the company’s $72 billion bid for the studio business and streaming operations of Warner Bros. Discovery, including HBO, announced last month. That deal is imperiled by the hostile bid of Paramount Skydance. Tuesday, before the earnings report, Netflix sought to cut off Paramount by switching their bid to an all-cash offer, rather than the prior mix of cash and Netflix stock.

The fact that the Warner deal is the main area of the Street’s concern reinforces in my mind that Netflix has become just media company, all about horse trading and “properties” rather than technological innovation.

At any rate, the shares are down six percent in pre-market trading, at $82.02, adding to what has been a poor performance amidst the Warner battle. The shares were flat for the past twelve months heading into this report.

I noted a week ago that Mark Zuckerberg’s Meta Platforms, the parent of Instagram and Facebook, is contracting for almost eight billion watts of data center “capacity,” with nuclear power plant operators for years into the future. The term capacity here means that Facebook and Instagram need that much power to run their machines, but, more important, the tons of artificial intelligence systems that Zuckerberg is building.

And, so, the AI boom that we are in can be measured in terms of millions and billions of watts of capacity. The question that has been hanging over investors is, How many gigawatts is too much? That’s a way of saying that the boom could implode like past manias.

To answer that, I spent the weekend digging through that infamous report put out by JP Morgan back in November, the one that projected $5 trillion worth of spending on data centers over the next five years by all the cloud giants.

Taiwan Semiconductor delivered the goods on Thursday morning, surpassing expectations with its forecast for quarterly revenue, the seventh quarter in a row it has exceeded expectations, and also meeting the elevated expectations for its capital spending.

As I mentioned on Tuesday, Jefferies & Co.’s Sherman Shang had warned that anything less than $50 billion in capital spending this year by Taiwan Semi would be regarded as a disappointment for Taiwan Semi’s equipment suppliers, especially ASML.

As it happens, CFO Wendell Huang said spending is going much higher than that this year, projecting $52 billion to $56 billion. And CEO C.C. Wei emphasized to analysts on the company’s Thursday morning conference call that costs keep rising substantially as the company transitions from one “node,” the size of transistors, to the next.

Taiwan Semi shares closed Thursday’s session up over four percent, at $341.64, and ASML rose by over five percent to close at $1,331.

Taiwan Semi’s growth at its scale is incredible. Its 2025 revenue, in U.S. dollar terms, rose just under thirty-six percent to $122 billion. CEO Wei said the company expects sales to rise another thirty-one percent this year. He also said the company’s total revenue growth, for the “long term,” will “approach” twenty-five percent, which is higher than the twenty percent Wei had promised in past.

This is turning out to be quite an interesting week for semiconductors, and, in particular, the chip-equipment makers that serve the chip makers.

Some equipment-maker stocks have been going up and up and up, and that has focused everyone this week on the question of whether artificial intelligence-related chip growth can continue to fuel hopes for equipment spending.

Case in point, shares of chip-equipment makers ASML and BE Semiconductor have had an amazing run in just a week and a half of trading in 2026, with ASML shares up nineteen percent and BE Semi up twenty-four percent.

The jump in ASML has brought cautious attention. “Expect a choppy ride” is the title Tuesday of a note by Jefferies & Co.’s Janardan Menon, who reiterates a Hold rating on ASML, warning that “Disappointments are likely, as demand outside AI remains weak.”

I noted in this week’s podcast that it is an open question whether corporate users of artificial intelligence will see benefit from the technology in time to save the huge investment boom that is going on in AI infrastructure, a boom that is driving shares of Nvidia, Micron Technology, and other infrastructure providers.

A hopeful view in that regard is offered by Citigroup’s software analyst, Tyler Radke, on Monday. Radke writes that “C-suite leadership is intensely engaged and driving top-down adoption” of AI, “which is different from prior technology cycles, and in many cases have formed dedicated AI budgets.”

That’s nice to hear. As Radke points out, it’s been hard to be a software investor. 2025 wasn’t too great. As he describes it, last year was “a year of broad software irrelevance.” Radke actually ends that phrase with a question mark, but I think it’s very much true. “As the broader market valuation approached record highs [such as Nvidia], most of our software universe (including megacaps) saw multiples continue to compress,” he adds.

Welcome to the first podcast of 2026. Markets have been up and down the last three weeks, with the first full week, the week ending January 9th, seeing a 2% rise for the major indices. The TL20group of stocks to consider has consistently performed better than the indices these past few weeks.

On the last podcast, the December 18th podcast, we were talking about the pressure on profits for companies in the AI trade. As Micron Technology rides a wave of DRAM and NAND price increases, companies including Nvidia and Broadcom have to navigate that.

As you might expect, the brokerage outlook for the new year is obsessed with whether there will be an AI payoff this year to justify the rise in the AI stocks, including Nvidia.

For example, Lisa Shalett at Morgan Stanley this past week offered that there is, “one singular known unknown” for 2026: Are U.S. corporations able to drive meaningful productivity gains from generative AI?

Friday’s news that Meta Platforms is contracting for almost seven billion watts of future energy generation with three nuclear firms seems a watershed moment for the group.

Shares of the two public nuke companies partnering, Oklo and Vistra, closed up eight and ten percent, respectively. Meta shares rose a point on the news. Meta already had a deal with Constellation Energy, and Constellation shares closed up six percent Friday. The fourth supplier is TerraPower, privately held.

Also surging on Friday was the stock of the most mature nuclear vendor, NuScale Power, closing up four percent. Interestingly, Oklo’s fellow newbie, Nano Nuclear, closed down three percent.

For Meta, it’s about “de-risking” its ballooning appetite for power for its data centers, writes Rosenblatt’s Barton Crockett. The deals announced today, plus the deal with Constellation previously announced, add up to 7.7 gigawatts of commitments. Those deals “vault Meta to the top of the leader board in hyperscalers going nuclear,” writes Crockett.

Cloud companies “going nuclear” has an ominous ring to it, I must say.

Crockett lays out quite nicely the escalating power needs Meta has outlined, rising to as much as twenty gigawatts annually in a decade from now:

The artificial intelligence trade always loves more candidates for AI momentum, and a big group of these were the data center names that transitioned last year from being crypto-currency mining outfits to being AI data centers.

I noted in June, that larger outfits such as CoreWeave were trying to meet raging demand for AI hosting by subcontracting to firms such as Applied Digital, a trend that continued to rise throughout the summer, so that by October, analysts were cheering the rising prospects of Applied.

Applied’s earnings report Wednesday evening, after market close, is adding to the fervor, driving shares up eight percent Thursday, to $31.93, giving it a return of two hundred and sixty-seven percent in the past twelve months.

This is the third time in a row that the shares have surged on earnings, and the proximate cause is not simply the results but the enormous backlog of deals for data center capacity the company is bringing in.

I wrote at the beginning of last year that the market for “plain-old chips,” semiconductors that go into the diverse markets of consumer electronics, automobiles, industrial equipment, etc., was headed for a rebound. That argument was premised on the fact the vendors were clearing their books of a pile-up of inventory, and were seeing demand broadly recover in markets that had been weak for two years, including consumer electronics products.

Turns out, I was a year early.

2025 had mixed results for those vendors, which include Microchip, Texas Instruments, and Analog Devices, the last of which is one of the TL20 group of stocks to consider. The tariff and trade drama of 2025 added extra complications to what was going to be a cyclical rebound in the traditional analog and mixed-signal chip market.

As a result, Microchip and TI trailed the broader market in 2025, while Analog Devices did just a little better, rising twenty-eight percent versus the Nasdaq’s twenty-one percent gain.

But Monday evening, after market close, brought the long-awaited good news that the plain-old stuff is now on that cyclical comeback. Microchip preannounced that its revenue for the December quarter will be “well above” what it had said back in November

The first week of the year begins with the Street trying to reconcile its excitement about the artificial intelligence spending boom with its anxiety about the potential implosion of that boom.

Monday, Morgan Stanley’s Lisa Shalett, writing for the bank’s Global Investment Committee, concludes that this year, it’s all about whether or not Artificial Intelligence will deliver a productivity payoff.

“All the bullish narratives of 2026 embed a singular known unknown—US corporations’ ability to drive meaningful productivity gains from GenAI,” writes Shalett.

She sees “apparent reasons to remain constructive” that AI will deliver such gains. The reasons include “stories” that Gen AI is “augmenting employee efforts,” stories that “are plausible and captivating,” writes Shalett.

Aggressive small-cap tech investors love to bet on long shots, even though returns can be hard to predict. Take the market for quantum computing, where returns are uneven and can seem somewhat illogical.

IonQ, the company with the most revenue in the industry, rose only seven percent last year, trailing the Standard & Poor’s 500, while smaller competitors D-Wave and Rigetti rose two hundred eleven percent and forty-five percent, respectively.

I don’t have much faith in these young companies given my skepticism about “scaling” quantum, as I explained in October. But, I’m just as fascinated with long shots in tech as anyone else.

One of my favorite long-shots in tech is not quantum but DNA computing, doing calculations with deoxyribonucleic acid, the stuff that makes up our chromosomes. I love the idea that we could compute via organic materials rather than silicon. The prospect of computing with our own human DNA, even inside of our bodies, is absolutely fascinating.

I tend not to look too much at the life sciences industry because I don’t have the background to properly assess the technologies and the companies involved.

However, I’ve noticed one characteristic that fascinates me, which is the dependence of biotech companies on one of my favorite companies, Nvidia.

Pretty much everyone in the world is dependent on Nvidia at the moment, of course, and the escalating cost to companies such as Snowflake, discussed in the previous post, is obvious.

Less obvious is the cost to life sciences companies such as Oxford Nanopore, a maker of genetic sequencing machines. These are used in labs to detect the pattern of nucleic acids that make up the code of DNA and RNA.

I thought I’d offer up a few derivatives to the positive outlook for memory-chip investments and storage investments mentioned in the prior post.

To the memory and storage theme, I’d add companies with important products for managing “big data” that will be worth keeping an eye on.

That includes TL20group of companies to consider member Snowflake, whose programs will be important for the loading and managing of vast amounts of data for AI-driven analytics.

After a healthy forty-two-percent return in 2025, what is exciting for Snowflake in 2026 is that the company will be moving into the realm of “online transaction processing,” or, OLTP.

I expect we’re in for another big year for storage and memory technologies, which should be good for Micron Technology, Seagate, and Western Digital.

That would be quite an achievement, given the fabulous returns on all of them in 2025, as listed in the table below.

For DRAM memory, the plans of tech giants such as Google to spend billions on artificial intelligence infrastructure, including Nvidia chips and all the rest, is fueling a huge appetite for memory chips.

I mentioned a year and a half ago that technologies of memory are becoming increasingly important as memory becomes the bottleneck of artificial intelligence. The surging price of DRAM has borne that out, as per Micron’s quarterly report last month.

Now, this is what I like to see at the start of a new year: the TL20 group of stocks to consider rising by a point on their first day while the major indices decline slightly.

Among gainers Friday is TL20 name ASML, the maker of photo-lithographic equipment for chip produciton. ASML’s stock got an upgrade from Sell to Buy by Warren Lau of Aletheia Capital, after Lau raised his estimates for this year and next, expecting stronger demand for “extreme ultra-violet” lithography, or, EUV, the most advanced of ASML’s tools. Lau expects demand among DRAM makers, in particular, to be a driver of sales.

This is a refutation of the “peak litho” story that was heard in June of last year, in which companies would buy less EUV equipment because they would instead simply package together simpler chips.

An interesting question for investors in Mega Cap tech is which of the three horsemen of cloud and artificial intelligence, Alphabet’s Google, Amazon, or Microsoft, will win out in the soaring market for AI in the cloud. The answer could be a big factor in their relative stock outperformance given that AI is going to be a big determinant of revenue growth but also expenses.

They all have very different business profiles, but I’m tempted to give Google the better odds here, with Amazon a distant second and Microsoft the least attractive of the three.

All three monetize AI in various ways, including the cloud computing services they rent, plus Amazon’s retail business and Google’s search and YouTube businesses. On the surface, it appears Microsoft has the best monetization strategy, as it now has ninety percent of the Fortune 500 paying money to use its “Co-pilot” AI assistant. Co-pilot allows Microsoft to charge more for each user of various software offerings including the “M365” productivity suite of Word and Excel, what used to be known as “Office.”

It seems everyone spent their Christmas holiday in the U.S. analyzing the deal by Nvidia to license technology from artificial intelligence startup Groq (not to be confused with the A.I. program Grok from Elon Musk’s xAI.)

As related by Bloomberg’s Ian King, Groq started life in 2016 as a chip maker, one of the many hopefuls convinced they could take share from Nvidia’s GPUs. After receiving $750 million in venture money, the latest bit in September, Groq is now licensing its chip technology to Nvidia, and proceeding in a different form as an independent company, running a cloud-based A.I. service for a fee.

Financial terms have not been disclosed, but the speculation is that Nvidia is spending as much as twenty billion dollars on this, which is not only a very large amount of money — Groq was valued at $7 billion following the most recent funding round — but also surprising given that Nvidia is getting a non-exclusive license to the technology.

I think the deal is not very significant, as I’ll explain in a moment, but the Street is generally enamored of the strategic virtues for Nvidia.

I’m a bit late in catching up with Nextpower, formerly Nextracker, which had a favorable report Tuesday evening that drove the stock up thirteen percent on Wednesday.

Shares also got a lift from the company’s first-ever share repurchase authorization, half a billion dollars over three years. That’s equivalent to three percent of the market cap.

Nextpower is the largest vendor of what are called “tilt trackers,” a precision electromechanical device that shifts the orientation of the solar panels throughout the day to make them catch the most rays possible.

Since November, when it rebranded the company, Nextpower has been expanding into related product categories. For example, it now sells “inverters” that manage power conversion in solar systems. That puts the company into some competition with, for example, Tesla’s energy business, which I talked about a little bit in yesterday’s Tesla article.

What I find most interesting about Nextpower, other than stellar results in Tuesday evening’s report, is its perspective on the electrical grid.