Palladyne AI CEO: ‘We’ve got a better mousetrap’ for robots

“If you want to be able to have a robot that can do two, three, four, five, ten tasks instead of just a single task, that's where we have the market opportunity.”

The TL Podcast with Check Point’s Gil Shwed: Faster growth is our biggest challenge

Gil Shwed co-founded Check Point Software Technologies thirty-one years ago based on his unique understanding of how to engineer the technology of firewalls as a robust defense in a networked age. As he turns over the baton in December to NadavZafrir, a career venture capitalist, entrepreneur and manager, Shwed plans to return to his roots, reflecting deeply on today’s landscape of threats to develop the next technologies that are needed.

In a wide-ranging video edition of the podcast, Shwed reflects on how he will spend his time as Check Point’s executive chairman, the challenges to Check Point’s growth, the role of artificial intelligence in cyber-security, and the continued waves of consolidation in the industry. Below is the full transcript of the podcast.

Can we pick winners in AI’s memory obsession?

The current infatuation with artificial intelligence has been fixated on the fastest processors that make AI possible, such as Nvidia’s GPU chips, and competing efforts from Advanced Micro Devices and Intel.

It’s clear, however, that the thing that will make or break AI going forward is memory, specifically, the circuits that hold the data that feeds data-hungry AI.

The speed and the energy efficiency of memory circuits such as DRAM have not kept pace with that of “logic” chips such as GPUs, leading to a disconnect: The faster the chips go, the more that memory is holding everything back.

Is that an investment opportunity? Reason dictates it should be. The problem of how to have really big, really efficient memory is one of the key challenges of the AI age. Herewith, some thoughts on how to play the memory race.

Tarana Wireless: One of those great unsolved tech problems that could go big

“Wireless technology has advanced to the state where, five years from now, we're going to look back and people aren't going to blink when they say whether it's wireless or fiber — it’s not going to matter.”

Pure Storage CEO: More and more, a software company

“We have been told by Adobe and other companies that have gone through this that fifty percent is roughly the turning point […] That’s when investors start paying attention.”

How’m I doing?

It’s been over three years since The Technology Letter got started. I’m interested to know what you think of what’s offered here.

Enovix sinks, but the news is not so dire

The Street hates surprises, which is why shares of Enovix, which is working on a revolutionary silicon-based lithium-ion battery, saw its stock drop over twelve percent Tuesday after it announced it would shift some its manufacturing focus from its factory in Fremont, California, to one in Malaysia.

I think the change may not be as dire a situation as people are taking it as. But Enovix is basically a startup company, facing plenty of challenges, and any perceived shift in its strategy can make the Street nervous.

Enovix CEO: building the world’s next great battery

“What the investors are betting on, is, that these guys will execute.”

Zscaler CEO Chaudhry: disrupting the old guard is a mega-opportunity

“We said, don't do network security, instead, simply build a smart switchboard that connects party party A to party B securely, and that's what has created a big opportunity.”

For ASML, AI increases everything

An interesting couple of notes appeared over the transom this week regarding Netherlands chip equipment titan ASML Holding, one of the TL20 stocks worth considering.

There was no immediate news event for these notes, just what appeared to be a spontaneous rush to endorse a good company’s stock.

The theme of the notes, you could say, was, Chip making is only getting harder, and that’s always good news for ASML.

In case you’re unfamiliar, ASML makes laser light sources for what’s known as photolithography, where a light is shown through a mask or screen, imprinting a pattern of circuits on the photosensitive layers of a semiconductor wafer such as silicon. That’s how circuits are carved into the wafer to become chips.

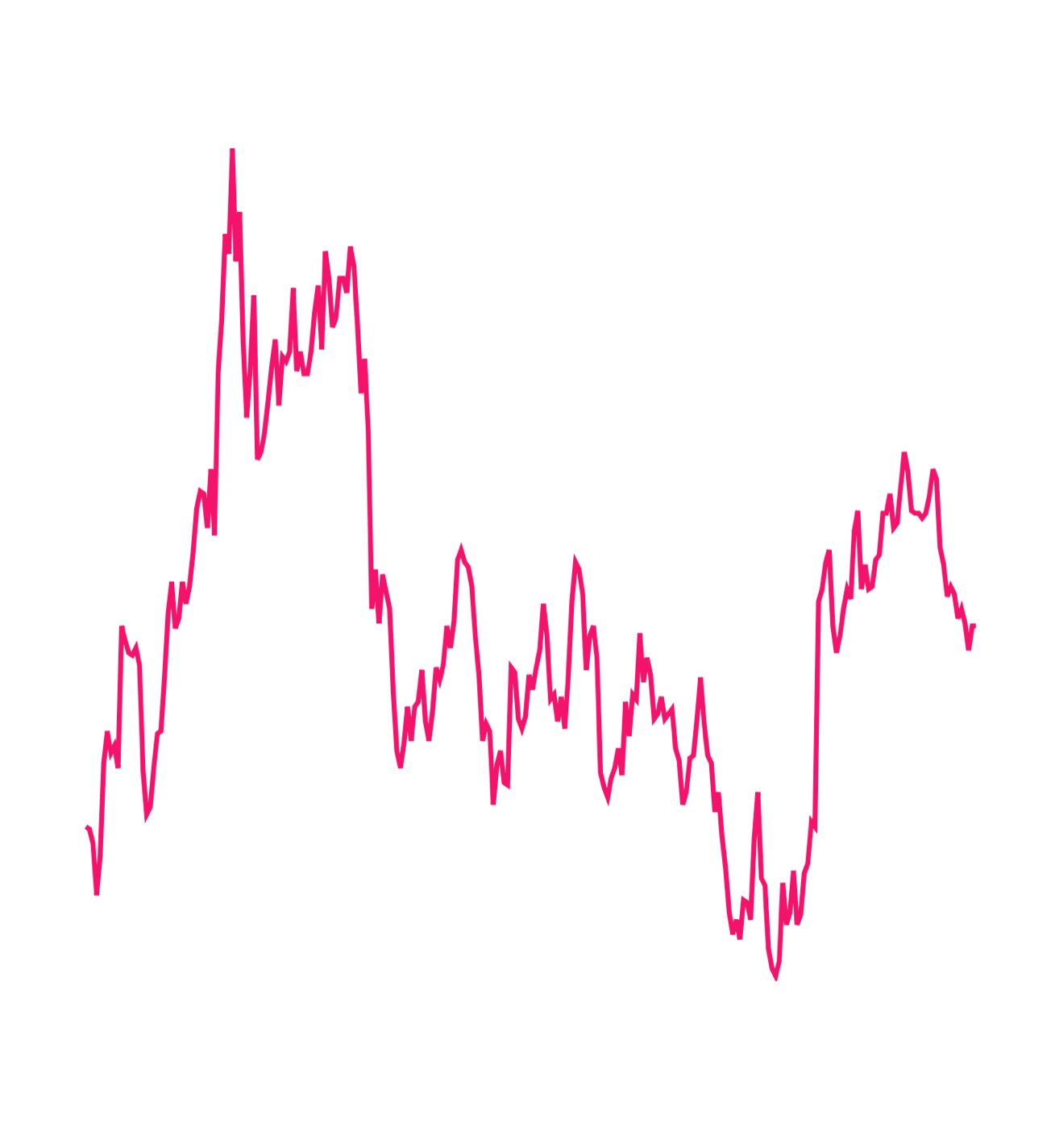

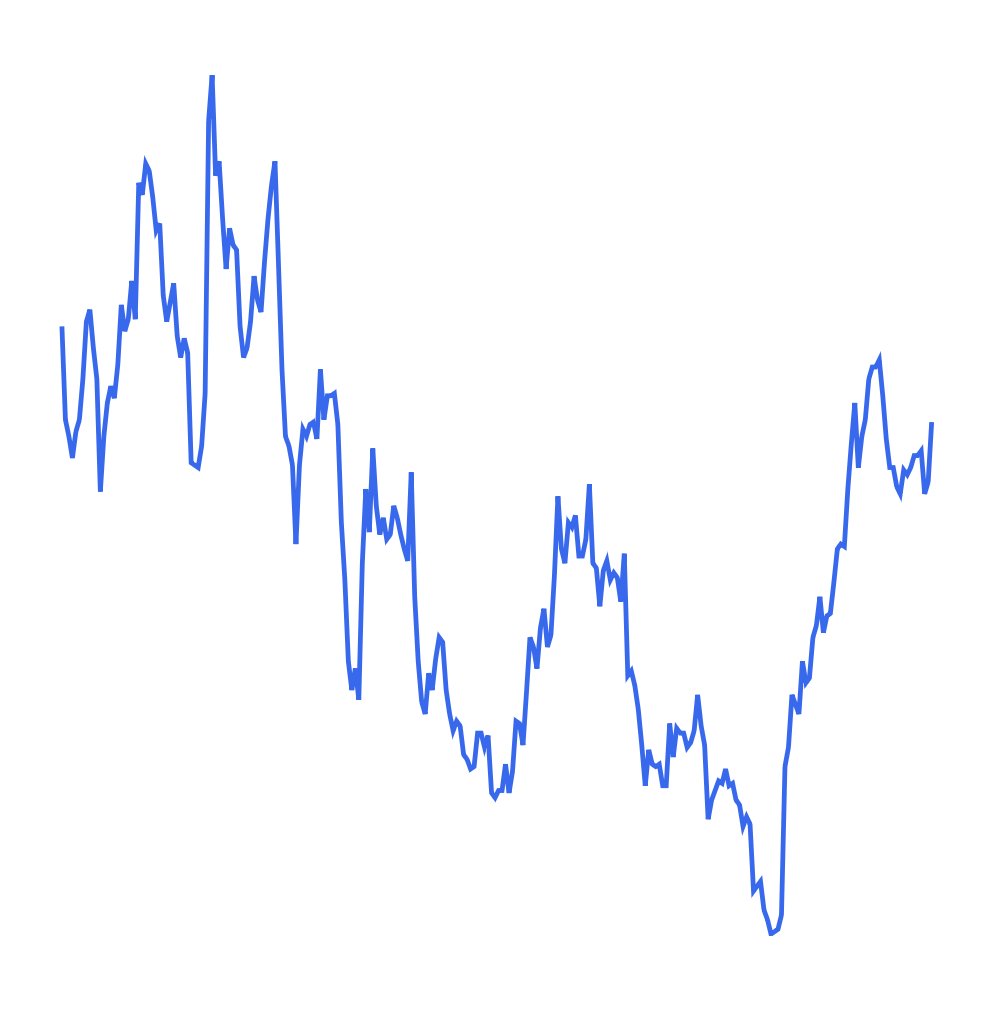

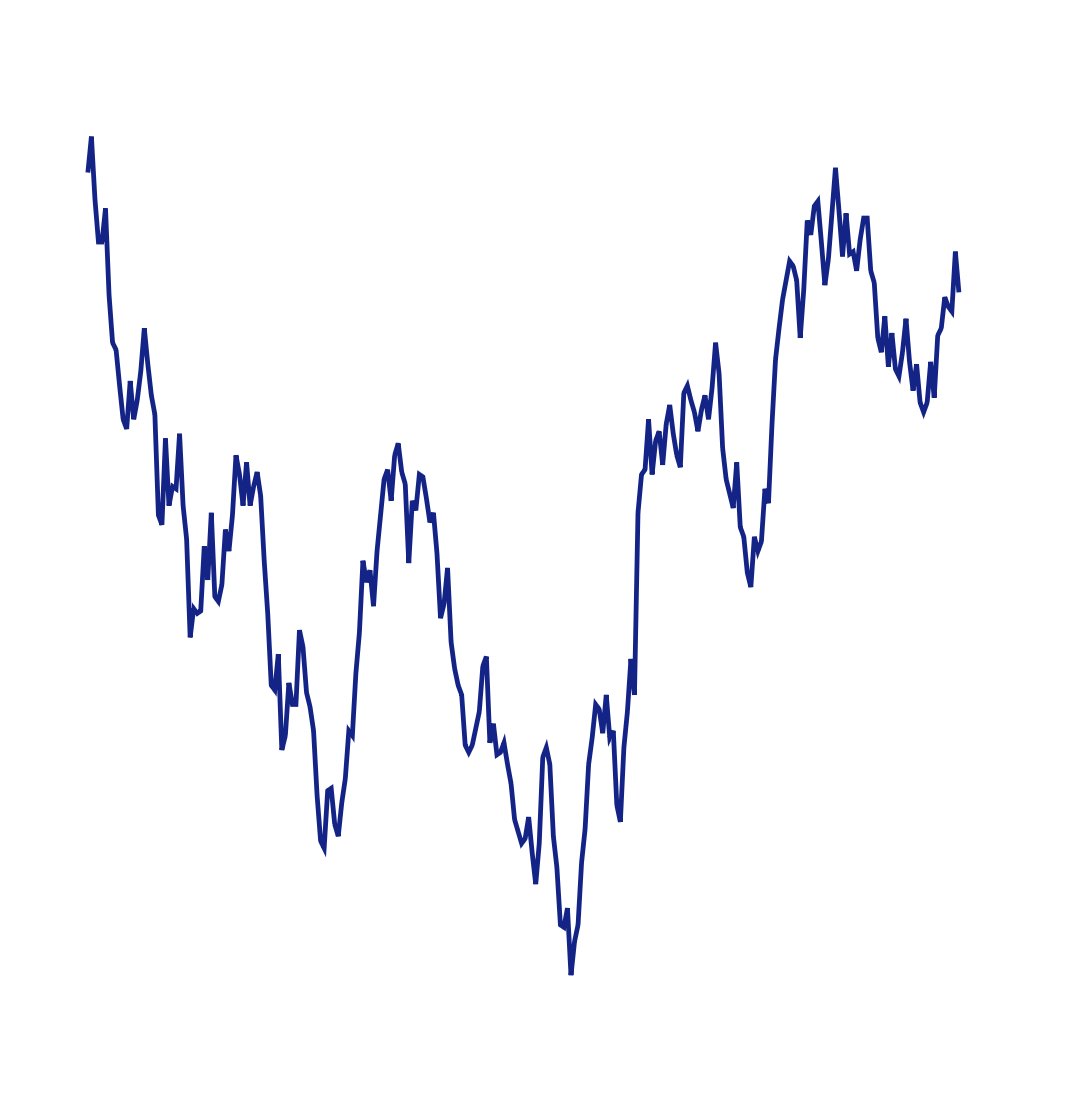

Some software stocks have gotten even cheaper

Despite an average rise of eight percent since the start of the year, many software company stocks are cheaper now than six months ago and one year ago, based on a group of one hundred and sixty-one software stocks out of a total universe of about five hundred and fifty U.S.-listed tech stocks.

The table below plots the change in one key measure for software stocks, their enterprise value divided by the next twelve months’ projected revenue according to FactSet consensus. Enterprise value is the total value of the company when you add up the shares outstanding and then subtract net cash, meaning, cash and equivalents and long-term investments, less long-term debt.