Enovix CEO: building the world’s next great battery

Enovix has a unique formula for making batteries, a silicon-based cell that can hold far more charge than graphite. It can double the capacity of today’s batteries in phones. If the company can successfully ascend the manufacturing curve, sales could soar in 2026. For investors, that represents an intriguing gamble that complex technology, years in the making, can finally be commercialized at scale.

Clarification: A prior version of this article cited Talluri’s comments about revenue from multiple production lines in 2025. Talluri meant instead to say 2026. The relevant passages have been updated to reflect 2026 instead of 2025.

A fundamental tenet broke down in technology in the past decade, the notion that computers with a battery tend to have less computing power than those that you plug into the wall.

The latest iPhone, running Apple’s “A16 Bionic” chip has more power than most desktop machines. It has to run not only the iOS operating system and applications, and intense video-game graphics, but also, increasingly, neural network algorithms for artificial intelligence applications.

The surge in computing power is taxing batteries more than ever. That crisis is creating opportunities to build companies with a unique approach to battery technology.

“People buy these phones, and they turn the display down to, like, half the brightness,” observes Raj Talluri, CEO of battery startup Enovix, in a meeting via Zoom that he and I had a week ago.

“I've spent thirty years building chips, but now it's come to the point where people can't really get the benefits of what they're buying,” he tells me. “The number one problem to solve is the battery.”

Talluri came to Enovix seven months ago from memory-chip maker Micron Technology, where he oversaw production of DRAM and NAND memory chips for smartphones. Making those chips, Talluri had an epiphany, he says. Putting the fastest memory together with the fastest processors means nothing if the power is not there.

“The ah-ha moment for me was when we did the LPDDR-5 [DRAM memory chip], which was running at eight gigahertz,” he recalls.

“I realized that although we have all this technology, no one can actually use it, because if you actually turned it on at full speed, the battery would go down so fast that your phone wouldn't even last.”

“I could break my head on another chip, but you know, they would use it for ten minutes,” before draining the battery, he muses.

While at Micron, Talluri began to look around at the companies in the battery field and concluded that Enovix was the one that “had the best chance of success, because it has a technology that really can make the battery twice as good.”

Enovix has a unique formula for making batteries, a silicon-based battery cell. It can double the capacity of today’s batteries in phones, and, down the road, reach even greater capacity, achieving ever greater battery life.

The company is just at the beginning of selling in volume. If Talluri can successfully drive the manufacturing effort to very high volumes, Enovix’s sales could soar from an expected one million dollars this year to hundreds of millions of dollars in 2026.

For investors, that represents an intriguing gamble that complex technology, years in the making, can finally be commercialized at scale.

“There's a little bit of a leap of faith,” says Enovix CEO Raj Talluri of investors’ attitudes about the manufacturing ramp. “A two-times higher-performing battery hasn’t been innovated in forever,” he says. “So, there's excitement, and at the same time there's a little bit of skepticism, can these guys really do it?”

A NEW KIND OF BATTERY

What does it mean to create a new kind of battery?

A battery is made up of multiple units that store a charge, called cells. The battery cell is a simple circuit, a movement of electrons between two poles, a positively charged electrode called a “cathode,” and a negatively charged pole called an “anode.”

When you charge your smartphone battery, electrons flow from the cathode and embed in the anode, where they are stored, in the form of lithium ions. When you use the battery, the reverse occurs, the movement of the lithium ions out of the anode and into the cathode.

The whole issue of how much power you get is a matter of how efficiently you move energy along that circuit, back and forth, filling and draining, but also how many ions can be embedded in the anode during charging. You want to really fill the anode.

And that turns out to be a materials problem. Anodes traditionally have been made of carbon-based materials, in particular, graphite. Graphite produces an anode that doesn’t always fill up with charge as well as it could.

“There's only so much lithium you can put into the graphite because of the structure of the graphite itself,” explains Talluri. The reliance on graphite anodes has stunted the field, he argues. “Lithium-ion batteries have only improved a few percentage points a year for the last few decades,” he says.

And so, Enovix has been focused on a different kind of anode, made of silicon, where you could really fill it to the rim. “Most people I talk to believe the next-generation batteries will be based on silicon, not graphite, across the board,” he says.

“The interesting thing about silicon is, it actually can take somewhere between six and ten times more lithium than graphite,” says Talluri. “And the reason for that, is, lithium doesn't just sit in the holes in silicon: it actually combines with it molecularly, it forms lithiated silicon.” Despite high absorption, silicon has an efficient release of lithium to the cathode in the drain process, when used to power things. “It gives it back, it gives quite a bit back,” says Talluri.

“So if you can just take graphite out and put silicon in, you just get a much higher-energy density battery — it's actually that simple.”

Well, not quite that simple. Despite its benefits as an anode, silicon has some catastrophically bad side effects. One is that as a charge builds up in the anode, the volume of the anode can quadruple.

“Silicon just expands, physically expands, and becomes really big,” says Talluri, “to the point where if you just replace graphite with silicon, and made a battery just the same way you made graphite batteries, it expands like a balloon.” Silicon in this way can “blow the back out of your phone.” Or catch fire. Or both.

Enovix engineers pondered the problem. There should be a way to simply constrict the phone case to contain that ballooning. “Why don't I just take a big, you know, metal case and just tighten the hatches on it to tie it down, so it doesn't expand?” was the initial thought, explains Talluri.

“Well, the problem is the amount of pressure silicon applies when it expands is close to two tons per square inch,” he says. That girdle would be just too big to be useful.

The company tried all sorts of work-arounds, including directly growing silicon anodes on wafers, but “nothing worked.”

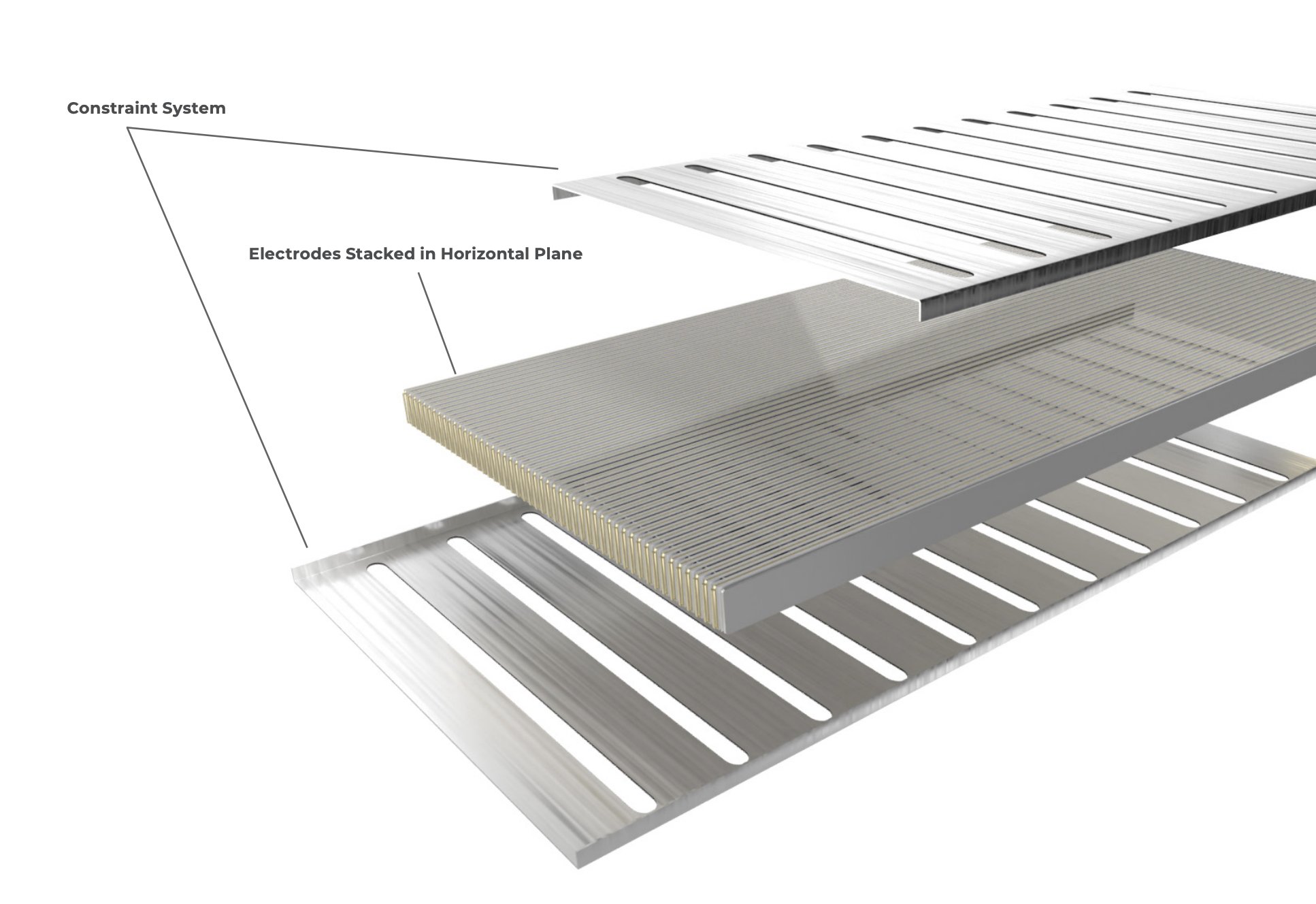

“And then they came up with this idea: why don't we cut anodes and cathodes in really thin strips, and make really tiny batteries, and stack 'em one on top of the other.”

Making a kind of Napoleon layer cake of anode and cathode layers, the structure can be turned on its side, whereby the pressure of engorged silicon can be reduced from 1.7 tons per square inch to two hundred pounds in a typical smartphone-sized battery. That amount of pressure can be clamped to prevent blowing out the phone. “It’s pretty amazing,” remarks Talluri of that insight.

The Enovix battery cell is like layer cake of electrodes sandwiched between slats of a futon that act as a constraint to hold in check the pressure of silicon as it expands.

The silicon strips result in “a battery that produces two times the [energy storage] density of some of the graphite cells,” says Talluri. Greater density means greater capacity. While there are a lot of details of filling and draining the battery, you could imagine getting twice the power in terms of hours of use.

The company’s inventions won the backing of a Silicon Valley legend, T.J. Rodgers, formerly CEO of Cypress Semiconductor, who serves as Enovix’s chairman. Rodgers has likened Enovix to another winner, solar inverter maker Enphase, which Rodgers turned around from near-bankruptcy in 2017 to twenty billion dollars in market cap today.

Rodgers, who is always hands on with his investments, has been vocal about the technology’s promise. A particular treat is a video he has filmed in which he explains the battery.

Rodgers has remarked that only one other company, Amprius, is able to put forth a pure-silicon battery. Enovix and Amprius, he says, may “both prosper,” just like Intel and Advanced Micro Devices in microprocessors, “as we argue whose battery technology is better.”

Source: FactSet

Competitively, Enovix is way out in front, by Talluri’s account. It is the only company making batteries with the anode entirely from silicon in high volume, he says. That starts to create economies of scale in using the silicon materials, he suggests.

“Even the traditional graphite battery makers have now started sprinkling a little bit of silicon into the battery to get more energy density,” he says, “but typically only a few percent.”

One-time Cypress Semiconductor CEO TJ Rodgers is chairman of the board of Enovix. He has compared the company to past successes he’s backed such as solar panel inverter maker Enphase. He has also defended the company at length against short-selling attacks.

“We have a hundred percent active silicon area because of our constraint,” meaning, the mechanism for managing silicon’s expansion. “So, the same material suppliers can supply to us a lot higher percentage of silicon” than they can to other customers. “And that's what we take advantage of in producing higher-energy-density.”

The focus on a silicon anode positions Enovix to buy from a number of suppliers of engineered silicon compounds as a basic ingredient, which is a good position to be in, a buyer’s market, in effect. The silicon is procured as a powder, which is then coated onto the strips that are fused together to make the layered cell.

“There are so many companies now” making silicon, Talluri notes, “there's so much innovation in materials.” Enovix is “material agnostic, so we can use any of those engineered silicons.” They all have different properties, he explains, with some versions of silicon providing more energy density than others, or being more resilient by having a higher cycle life (the number of times you can charge them). Some silicon charges faster.

“Now that we have got this mechanical constraint way of making batteries work, we are shipping one recipe, but we will continue to take advantage of the innovation in the materials,” says Talluri, “so that we make higher and higher-energy density batteries.” He alludes vaguely to a doubling each year in capacity of the cells, though that shouldn’t be taken as a market promise.

GETTING TO HIGH VOLUME

Designing the battery has taken sixteen years, and now the really hard work begins: manufacturing in volume.

Enovix is selling in very low numbers at the moment. In the most recent quarter, the June quarter, announced last month, the company sold just ten thousand cells, for a total of $42,000 in revenue. It produced a total of twenty-thousand, five hundred cells, and the forecast is for just thirty-six thousand cells to be produced in the present quarter.

For Talluri, the manufacturing challenge is the culmination of a multi-year education in making things. Prior to Micron, he ran the Internet of Things business at chip giant Qualcomm. That business designs chips to go into watches and industrial infrastructure, and game players, and many other objects.

Qualcomm doesn’t make anything, in the sense that they farm out their chip manufacturing to Taiwan Semiconductor Manufacturing. But at Micron, which owns factories for memory-chip making, “I got my hands dirty,” he says.

“You talk to the customers about the requirements, you define the product, you do the design, then you actually manufacture, then you get the yields up, and packaged, and all the way from cradle to grave,” he recalls. “It’s super fun, and that’s what we’re doing now” at Enovix.

The first challenge in making the silicon batteries is not the batteries themselves, it is making the machines that make the batteries. Enovix is a little like Tesla. Just as Elon Musk has said the hardest thing is building manufacturing processes for cars, Enovix is figuring out the best way to assemble the stack of electrodes that makes up the cell.

“You have to build the machines that actually cut these anodes and cathodes, and stacking machines, and machines that make constraints that hold 'em together,” says Talluri.

Those machines are “very similar to the semiconductor back-end,” he observes, referring to machines that put finished computer chips into packages with connecting pins. The Enovix machine consists of a laser, “a patterning part,” as he terms it, “that cuts the things into little pieces,” combined with “a stacker, which actually stacks all these strips, and then a mechanical constraint part that takes the strips and puts the constraint around them.”

The individual parts that make up the machines are, in fact, sourced from suppliers in the chip packaging field. However, “the machine itself is designed by us, tailored to the architecture of the battery, tailored to the electrochemistry,” he says. “And, so, it's a holistic, vertically integrated, very, very strong IP [intellectual property] position, and not easily copyable.”

Once Enovix builds one machine, “we can make more of them pretty quickly.”

A MULTI-LANE HIGHWAY

Once the machines are ready, scaling up the factory lines is the next challenge. The existing facility, in Fremont, California, is not where the company will make the bulk of its product. Instead, a new factory, currently being designed for construction in Malaysia, will come online next April. It will not only increase volume to millions of units annually, it will make possible the production of batteries of different sizes and shapes. That is essential, for Talluri aims to sell batteries for not just phones but also smartwatches, laptops, and all other manner of devices.

“We need to have the ability to make custom batteries, in the sense that the chemistry is all same, but the physical dimensions are custom to that device,” explains Talluri. Again, his past experience is key to Talluri’s grasp of the market. The Qualcomm Internet of Things business is typical of the wide variety of products that may use Enovix batteries.

“These are medical devices, these are wearables, these are speakers, these are headsets,” and on and on. Each of those could be millions of units, tens of millions of units, or only hundreds of thousands of units. “A Samsung watch could take a few million [batteries], but a Garmin watch could take fewer,” he notes. That means every custom battery cell size is a gamble on a particular market slice that may or may not pay off. Hence, “The question we have to ask ourselves is, Where do we want to sell? Which one do we sell first?”

The first samples of batteries made in different sizes in Malaysia will come off the line in April, and full production will be toward the latter part of 2024. That will be in low volume at first, he says.

“The consensus estimate for next year’s revenue is still pretty small,” he notes. In fact, just sixteen million dollars, according to FactSet, up from what may be a grand total of one million dollars this year.

“2025 is when we expect to be in really high volume in phones,” says Talluri. “To give you a feel for it, one [production] line that we are building in Malaysia, when it's fully operational, will produce about nine million batteries a year; in 2026, you should assume that we will have four lines each producing nine million batteries a year.”

If that plays out, “we’re looking at three or four hundred million [dollars] in revenue in 2026,” he says. “And then, of course, we'll have to make the next factory and try to get to ten lines, and really scale up the business.”

A BET ON MANY THINGS COMING TOGETHER

While building supply is one factor, demand itself is a moving target.

Typically, a phone will sell two or three million units per model. “Let's say we negotiate a battery price of eight bucks or nine bucks, then you can say two to three million times that, that's the revenue for that model, right? Then we add that up among all the different sockets that we have, all the different customers, and that gives the prediction of what the revenue can be in 2026.”

But all those phones, watches, computers and other things won’t ship for a year to a year and a half from when discussions start with the customer. And the actual purchase order won’t happen until roughly sixty to ninety days before Enovix ships the battery. That leaves a large gap of time between first discussion and shipment during which a customer project can fall through for any number of reasons.

“One model [of phone] may get changed, or they may decide not to do it,” he explains. “They may say, You know what, that's not selling very well, or whatever,” and cancel a particular model.

A deal, then, is “not money in the bag, by any means.” For that reason, “If you look at our funnel [of new business], the revenue pipeline is much higher than our ability to make manufacturing lines.” In other words, Enovix is over-subscribing its manufacturing, building in a margin for some work to ultimately go away.

To keep score, Talluri tells investors each quarter the current size of the pipeline of business. Last quarter, that pipeline rose nine percent, to $1.59 billion. Within that, some business is closer to being revenue, referred to as “active designs and design wins.” Those prospective deals stood at $737 million at the end of the second quarter, up from $718 million a quarter earlier.

The pipeline is “an indication of the progression of the design from sampling through getting a commitment,” explains Talluri. “We give them a few samples, and they test them, and then they say, it’s working the way you said it would, we want to put it into this particular kind of project.

“That’s when we’ve moved from initial opportunity to an active design.”

Backing up that pipeline is customer reception that he says is highly positive. “We show samples to customers, and they love it,” he tells me. During a Canaccord Genuity tech equity conference this week, Talluri was interviewed onstage by analyst George Ganarikas, a bull on the stock. Talluri recalled how, during a recent tour of Asia, he talked to customers such as phone maker Xiaomi about Enovix’s batteries, and “the response was amazing.”

“Actually, almost all of them wanted to start the program immediately with us,” he said of phone makers.

Far beyond the immediate future of wearables and phones and laptops, Enovix’s technology is applicable to electric vehicles. At the Canaccord event, Talluri laid out the long-term vision for EVs.

“The EV is a huge market, and the technology advantage we have is, one, of course, more energy density, and, more importantly, fast charge,” Talluri told Gianarikas. It can take up to forty minutes to charge a Tesla, he noted, whereas, “We can charge much, much faster because we can dissipate heat really, really fast in this unique architecture.”

“That's very exciting for many of our auto OEMs,” said Talluri. “And we're in the middle of working with them to get this technology into that marketplace also.”

The pipeline, the design wins, the enthusiasm about first samples all form the basis of investments that Enovix will make. “It gives us the ability to plan how many factories we should build, and how much money we should raise and so on.”

The company will spend almost two hundred million dollars this year to build machines and outfit the new factory. That amount was able to be reduced thanks to a seventy-million-dollar investment from the government of Malaysia. Countries that want more Enovix factories on their shores will be one important source of funding, Talluri says.

With net cash of a quarter-billion dollars, Enovix doesn’t need to raise capital for the low-volume stage. But, “ultimately, this is a capital-intensive business,” he notes, “so, we need to raise money.”

Wednesday, the company filed a shelf registration with the Securities & Exchange Commission — essentially, a placeholder — for potential future sale of up to a quarter of a billion dollars worth of stock.

WHAT IS THE BET WORTH?

Given all those puts and takes — the vast market, the timing of factories, the quality of projects, the future dilutive effect of equity offerings — Enovix is a bet on many moving parts.

What should that kind of bet be worth?

It is a controversial topic. “The problem here is that we have one million in revenue this year, and I'm forecasting hundreds of millions two years from now, right?” Talluri says.

“So, there's a little bit of a leap of faith there,” he says. “A two-times higher-performing battery hasn’t been innovated in forever,” he says. “So, there's excitement, and at the same time there's a little bit of skepticism, can these guys really do it?”

The Street has built valuation models for Enovix stock, he notes, and “they look pretty good to me.” Enovix gives the analysts “a lot of data, we spend a lot of time with them,” helping them think through the timeline of factory-building and volume manufacturing ramp.

Gianarikas, the Canaccord analyst, for example, has a $22 price target on the stock, a third higher than a recent price of $16.50. With one hundred and seventy-four million fully diluted shares outstanding, after subtracting a quarter-billion in net cash, that price would give the company an enterprise value of $3.6 billion.

Enovix is expected to lose money through 2025, even with a sharp ramp in revenue, and so if you want to take a multiple of anything, it’s sales. Gianarikas models $189 million of revenue in 2025, which would give the stock a multiple of nineteen times. That is an incredibly steep multiple for a hardware maker. His estimate could turn out to be conservative. A few hundred million dollars of sales in 2026 would knock that multiple down to twelve times, which would be merely expensive.

Before you dismiss that prospect entirely, consider that in Talluri’s view, the situation is really binary. Success won’t be progressive, it will be sudden and sharp, a switch flipped from almost no revenue to a gusher of sales.

“Once you build the [manufacturing] lines, suddenly you're gonna be at three hundred million [dollars in revenue],” he says. “So, it’s not like one million, two million, three million — it doesn't go slowly like that, it’s, just, boom! If you can sell all the output of the factory, the revenue's gonna be there.”

The binary event has invited short sellers, of course, who have questioned whether the company will reach its manufacturing goal given past stumbles. Chairman Rodgers, when he ran Cypress, used to publish letters explicitly telling investors how to value Cypress stock. Similarly, he has been active in defending Enovix from the shorts.

In an internal memo, Rodgers related his correspondence last month with undisclosed parties at NBC-Universal. He pushed back on what he deemed “hatchet-job,” questions from the reporters. There are “a staggering thirty-four million shares of Enovix shorted,” Rodgers observed in his letter, equivalent to a quarter of the float.

While he focused the long and rambling piece on attacking the shorts, Rodgers took take care here and there to emphasize the acumen of Talluri and the engineers, declaring, “Enovix is a very technically competent company.”

In our discussion, Talluri did not bring up the shorts. Instead, he laid out, in fairly sober fashion, the issue for the long investors. “What the investors are betting on, is, that these guys will execute,” meaning he and his team. At one time, he recalls, most investors, not just short sellers, doubted the company could make anything. Since he came aboard seven months ago, Enovix has surpassed every single production milestone Rodgers has set, he notes.

On a more basic level, Talluri believes that great waves of innovation become very big businesses in the hands of astute teams. Over thirty years, he made such waves happen, first at Texas Instruments, where he built a multi-billion-dollar mobile processor business called “OMAP,” and then at Qualcomm, where he built two multi-billion-dollar businesses, the “Snapdragon” mobile processor business, and the Internet of Things.

From Talluri’s standpoint, it all comes back to the mission. “My conviction has become even stronger the last few months” regarding the mission, he says. The pressure on battery power is escalating.

Take Apple’s forthcoming “Vision Pro” headset. “So much technology went into six cameras, but the battery lasts two hours,” he observes. “Clearly, you can provide the experience, but you need a better battery.”

With devices such as the Vision Pro, and with the imminent arrival of “generative AI” programs on handsets, and with all of the future battery hogs, he assures me, the crisis is “only getting worse, really.”

Enovix shares are up thirty-three percent this year, and down twenty-three percent in twelve months.